|

Staying Proactive

Our team helps you invest your retirement assets for long-term financial independence using this proactive asset allocation plan, which means we do not recommend buying and holding all investments. A key element to growing your investments over time is to take action designed to preserve your wealth in bear markets.

While we understand that diversification is an important investment concept, our team realizes that diversification alone does not prevent portfolio losses. This is demonstrated by the losses investors experienced in the prolonged bear market of 2000 to 2002 or the more recent bear market that began in October of 2007.

|

Wealth Accumulation Strategies

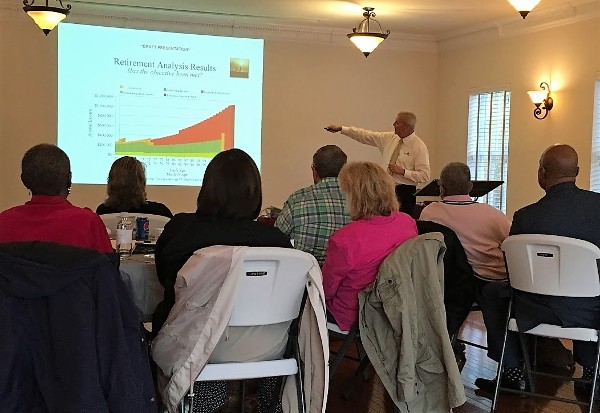

In addition to staying proactive, making a plan using proven wealth accumulation strategies is essential. Simply stated, wealth accumulation starts by creating the blueprint for a gradual increase in your investment portfolio. When you establish a course of action and develop an overview of your financial landscape, you can project how your investments will fare in the market. Experts in investment management can help you decide how to protect your financial future. Although it may seem decades away, the older you get, the faster the years pass. Starting early with a wealth accumulation strategy will serve you well during your retirement years.

Talk to our professionals about developing a plan to achieve financial security. Your goals are our goals, and we’ll work with you one-on-one to ensure the objectives are realistic based on your current and projected income and assets. Years of experience in portfolio and asset management services means we can offer our clients the assistance needed to make sound decisions about their finances. Wealth accumulation strategies are just one piece of the puzzle to securing a comfortable future. Everyone is an individual, and that is how we approach each consultation. Ask us today how we can help you create the retirement of your dreams.

Excellent Reasons to Consult a Financial Advisor

While you may have a handle on your financial landscape, there is always room to better protect your money. A financial advisor is your first choice for helping to manage your income and assets for several reasons.

Protect Your Family

Should anything happen to you, you want to know your family is secure. A financial advisor can help you develop a plan to protect those you love.

Plan Your Spending & Saving

Managing your incoming salary and outgoing expenses can be challenging, especially if you have a complex portfolio. A financial planner will assist with finding a balance between the two.

Plan for Retirement

We have all thought about it, but thinking isn’t going to get us the retirement we want. A financial advisor is your best bet for securing your golden years.

Meet Your Investment Goals

If you have goals you want to achieve, you need a plan to get there. Talking to a financial planner will put you on a course to meet and even exceed your expectations.

Save Money

The primary reason most people turn to a financial advisor is to save money. Advice from an expert can put you on the right track no matter your situation.

Hands-On Management

Portfolio management services are available for those with assets of $50,000 or more. Our average client is someone who has worked hard over the years to save in their company retirement plan and is looking for more hands-on financial services to protect their hard-earned savings.

Contact us to discuss the benefits of an active portfolio. We are proud to serve our clients in Florissant, MO, and surrounding areas.

There is no guarantee that active asset management will outperform a buy and hold approach to investing. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee or protect against loss in periods of declining values. Past performance is no guarantee of future results.